alameda county property tax rate

The tax type should appear in the upper left corner of your bill. 1025 Alameda County California sales tax rate details The minimum combined 2021 sales tax rate for Alameda County California is.

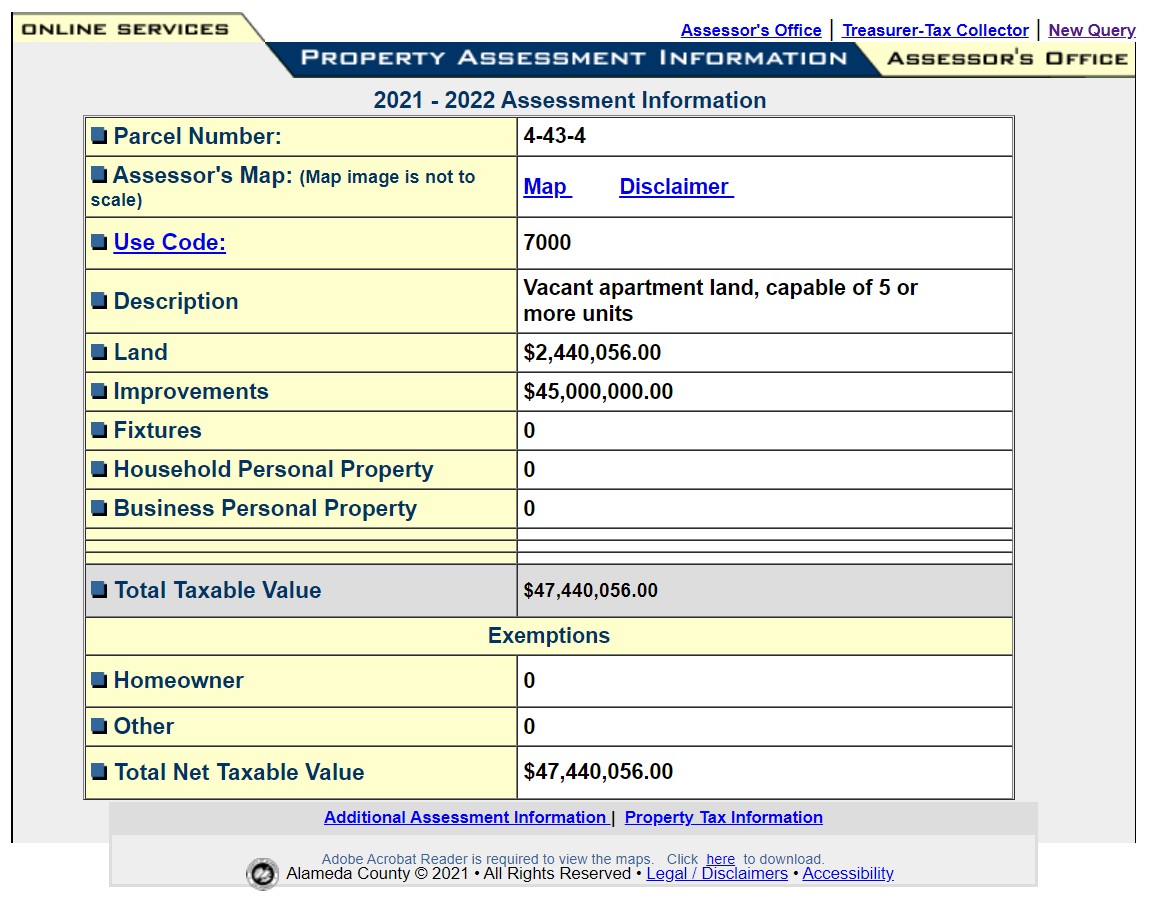

Alameda County Property Tax Tax Collector And Assessor In Alameda

Tax Analysis Division - Auditor-Controller - Alameda County.

. California State Sales Tax. The majority of the county is made up of single-family homes. Property Tax Rates and Refunds.

Residents of Alameda County where the median home value is 707800 pay an average effective property tax rate of 078 for a median tax bill of 5539. If you need to find your propertys most recent tax assessment or the actual property tax due on your property. This generally occurs Sunday.

The Alameda County assessors office can help you with many of your property tax related issues including. While observing constitutional checks mandated by statute Alameda creates tax rates. When you perform the previous step the property tax bill will be automatically downloaded and you will be able to rectify the alameda county property tax rate.

The median property tax also known as real estate tax in Alameda County is based on a median home value of and a median effective property tax rate of 068. Pay Lookup Property Taxes Online. Alameda County Sales Tax.

There are several ways to. You can search for tax rates based on parcel number. Overall statistics can be misleading because there is so much diversity from city to city.

What is the tax rate in Alameda County. Explore the charts below for quick facts on Alameda County effective tax rates median real estate taxes paid home values income levels and. Many vessel owners will see an increase in their 2022 property tax valuations.

Left to the county however are appraising property sending out bills performing collections. In comparison to the 3414 state average and the 279 national average the average county tax bill is close to. Property Tax Appraisals The Alameda County Tax Assessor will appraise the.

The system may be temporarily unavailable due to system maintenance and nightly processing. Alameda County Property Tax. As a county the average tax.

This creates a wide disparity in terms of taxation from 2600 to 10000. Those entities include your city Alameda County districts and special purpose units that produce that composite tax rate. If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows.

Lookup or pay delinquent prior year taxes for or earlier. Who and How Determines Alameda County Property Tax Rates. The valuation factors calculated by the State Board of Equalization and.

Provides the detail for the tax rate used in calculating that portion of your property tax bill based on the assessed value of your property. Alameda County Stats for Property Taxes. Please choose one of the following tax types.

The alameda property tax rate. Fremont City Sales Tax. For comparison the median home value in Alameda County is 59090000.

Dear Alameda County Residents.

Editorial Don T Let These Six Cities Take Your Home Equity

Taxation In California Wikipedia

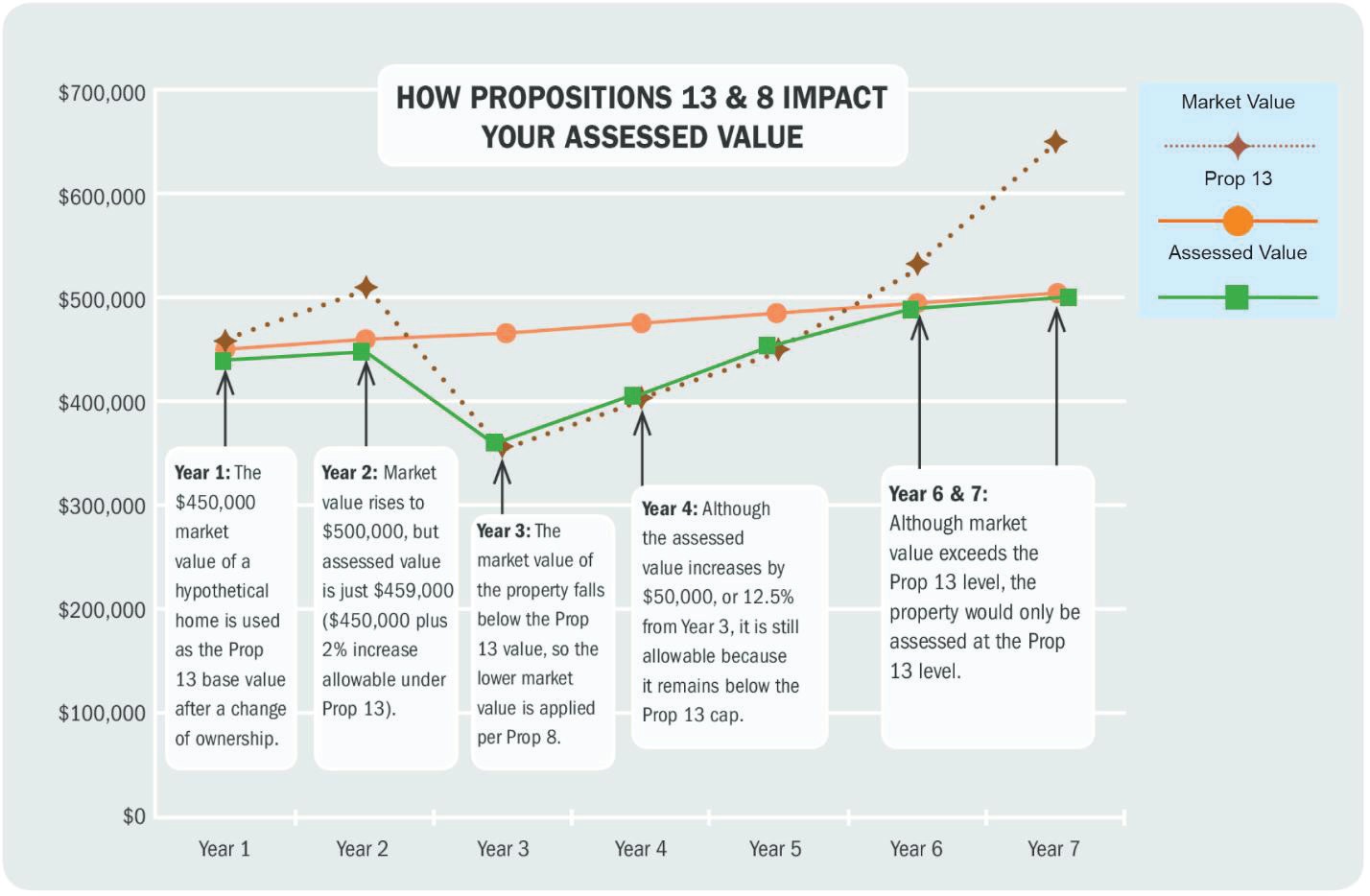

Proposition 19 Alameda County Assessor

Alameda County Real Estate Transfer Taxes An In Depth Guide

Claim For Reassessment Exclusion For Transfer Between Parent And Child Ccsf Office Of Assessor Recorder

Alameda County Ca Property Tax Calculator Smartasset

California Property Tax Calculator Smartasset

Senior Exemption Waiver Measure I

Funding Seamless Transit Part 2 Who Pays What For Transit In The Bay Area Seamless Bay Area

Property Tax By County Property Tax Calculator Rethority

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Editorial During Pandemic Albany Wants Three Tax Hikes Vote No

Proposition 19 Alameda County Assessor

Michael Barnes Albany City Council Meeting Comments And More Page 2

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

How Much Does Your Berkeley Neighbor Pay In Property Taxes See A Map